Page 5 - BROCHURE-led-new-en

P. 5

5

5

4 Partners Partners Partners

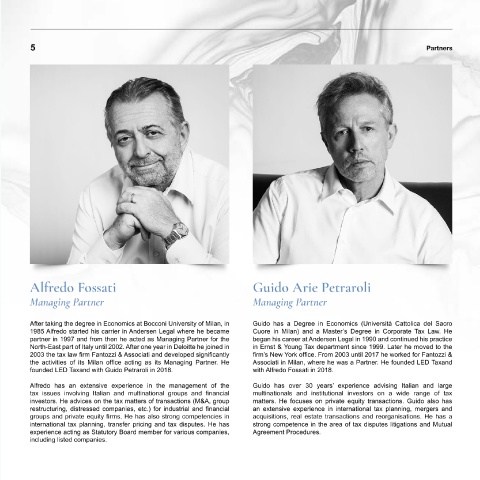

Alfredo Fossati Guido Arie Petraroli

Managing Partner Managing Partner

After taking the degree in Economics at Bocconi University of Milan, in Guido has a Degree in Economics (Università Cattolica del Sacro

1985 Alfredo started his carrier in Andersen Legal where he became Cuore in Milan) and a Master’s Degree in Corporate Tax Law. He

partner in 1997 and from then he acted as Managing Partner for the began his career at Andersen Legal in 1990 and continued his practice

North-East part of Italy until 2002. After one year in Deloitte he joined in in Ernst & Young Tax department since 1999. Later he moved to the

2003 the tax law firm Fantozzi & Associati and developed significantly firm’s New York office. From 2003 until 2017 he worked for Fantozzi &

the activities of its Milan office acting as its Managing Partner. He Associati in Milan, where he was a Partner. He founded LED Taxand

founded LED Taxand with Guido Petraroli in 2018. with Alfredo Fossati in 2018.

Alfredo has an extensive experience in the management of the Guido has over 30 years’ experience advising Italian and large

tax issues involving Italian and multinational groups and financial multinationals and institutional investors on a wide range of tax

investors. He advices on the tax matters of transactions (M&A, group matters. He focuses on private equity transactions. Guido also has

restructuring, distressed companies, etc.) for industrial and financial an extensive experience in international tax planning, mergers and

groups and private equity firms. He has also strong competencies in acquisitions, real estate transactions and reorganisations. He has a

strong competence in the area of tax disputes litigations and Mutual

Partners experience acting as Statutory Board member for various companies, Agreement Procedures.

international tax planning, transfer pricing and tax disputes. He has

including listed companies.